1.124.801

kiadvánnyal nyújtjuk Magyarország legnagyobb antikvár könyv-kínálatát

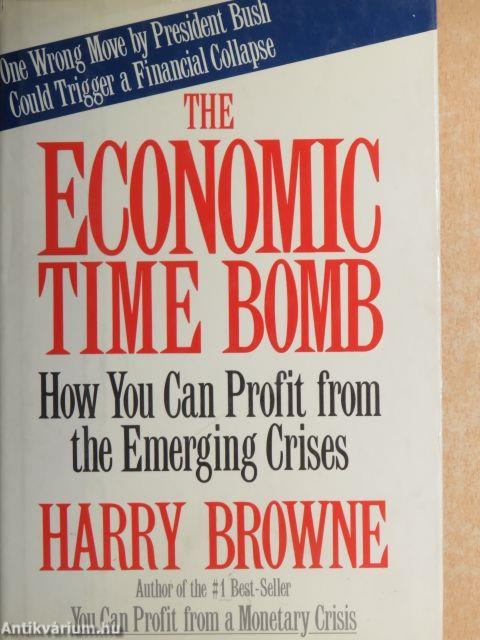

The Economic Time Bomb

How You Can Profit from the Emerging Crises/One Wrong Move by President Bush Could Trigger a Financial Collapse

| Kiadó: | St. Martin's Press |

|---|---|

| Kiadás helye: | New York |

| Kiadás éve: | |

| Kötés típusa: | Félvászon |

| Oldalszám: | 309 oldal |

| Sorozatcím: | |

| Kötetszám: | |

| Nyelv: | Angol |

| Méret: | 24 cm x 16 cm |

| ISBN: | 0-312-02581-5 |

naponta értesítjük a beérkező friss

kiadványokról

naponta értesítjük a beérkező friss

kiadványokról

Előszó

TovábbFülszöveg

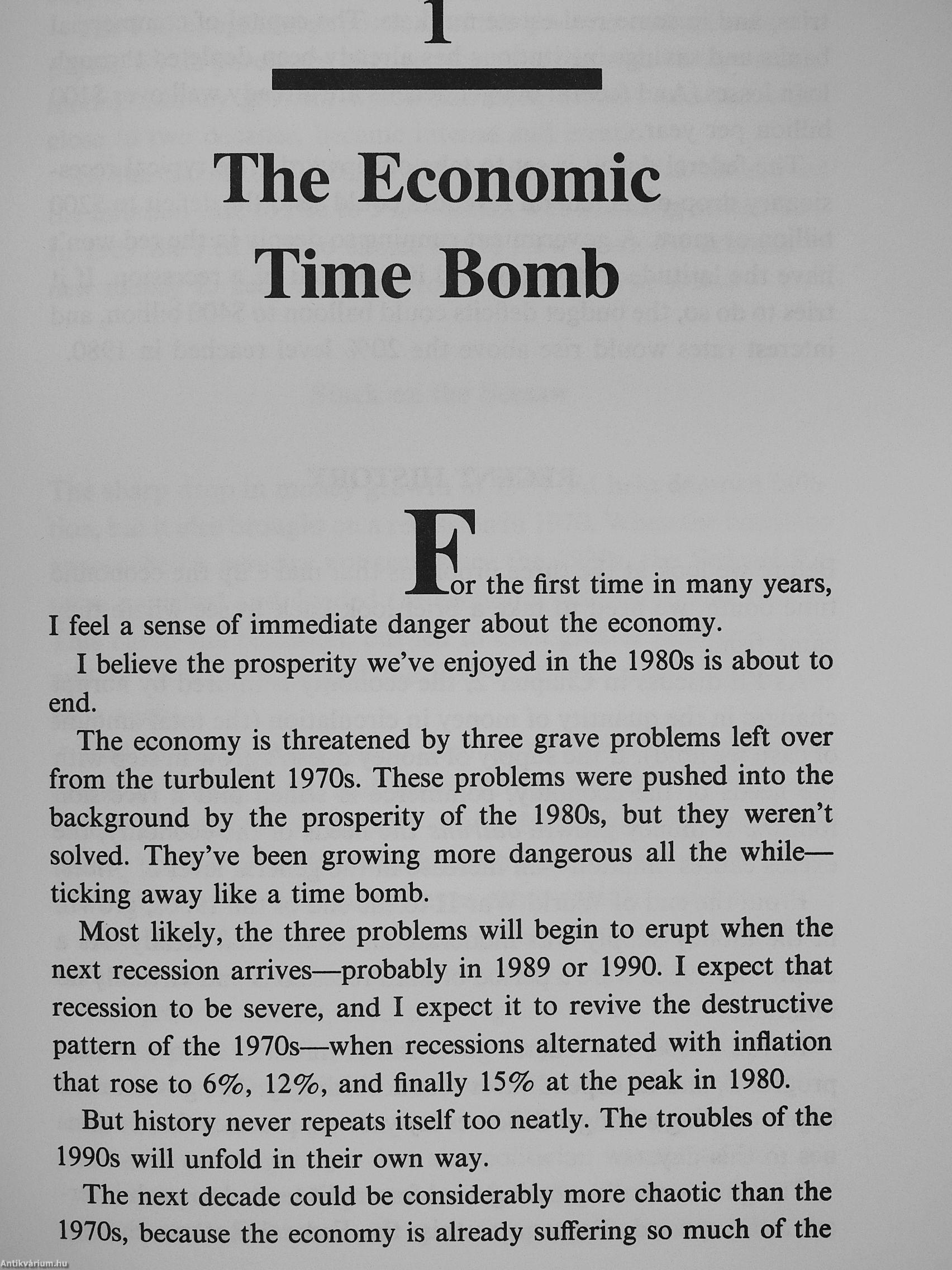

GET READY FOR A NEW ROUND OF CRISES

If you followed Harry Browne's advice in the early 1970s, you profited from the devaluation ofthe dollar, from the years of inflation that followed, and from the skyrocketing prices of gold and silver. If you followed his advice at the end of the 1970s, you were ready to profit from the healthier economy of the 1980s.

Now he warns that the good times are about to end, and that you must prepare for crises that may be worse than those of the 1970s.

In this book he explains The Economic Time BomJ)

• Why you must be ready for both a deep recession and severe inflation.

• Why deposit insurance doesn't make your bank account safe.

• Why some money market funds are dangerous investments.

• How frustration over the trade deficit could trigger the next depression.

• Why the government's plans to stabilize the stock market could cause a panic even bigger than the 1987 crash.

• Why the federal budget deficits haven't created the inflation and... Tovább

Fülszöveg

GET READY FOR A NEW ROUND OF CRISES

If you followed Harry Browne's advice in the early 1970s, you profited from the devaluation ofthe dollar, from the years of inflation that followed, and from the skyrocketing prices of gold and silver. If you followed his advice at the end of the 1970s, you were ready to profit from the healthier economy of the 1980s.

Now he warns that the good times are about to end, and that you must prepare for crises that may be worse than those of the 1970s.

In this book he explains The Economic Time BomJ)

• Why you must be ready for both a deep recession and severe inflation.

• Why deposit insurance doesn't make your bank account safe.

• Why some money market funds are dangerous investments.

• How frustration over the trade deficit could trigger the next depression.

• Why the government's plans to stabilize the stock market could cause a panic even bigger than the 1987 crash.

• Why the federal budget deficits haven't created the inflation and high interest rates people had feared.

• Why the budget deficits have reached a limit now—one that can cause the worst recession since World War II.

• Why the economic time bomb is set to explode—and how one wrong move by the president or Congress could set it off.

and How You Can Profit from the Emerging Crises

• How your savings and investments can be safe—no matter what happens—without your having to watch them.

• How you can profit from the crises without risking what's precious to you.

• Why you don't have to bet everything on anyone's predictions for the future.

• How to make sure your savings are safe and your wealth is protected.

• How a single strategy—requiring no expertise or attention—was successful in the 1970s when gold was soaring, was profitable in the 1980s when stocks and bonds took off, and will keep you safe and sound in the 1990s when chaos may reign again.

• How you can protect yourself from crashes, panics, inflation, depression, bank failures, and anything else—and be able to profit from whatever happens.

Harry Browne is America's #1 source of finding protection and profit in an economic crisis. For twenty years, he has been keeping investors safe and sound—and helping them profit in every economic climate.

1 ; ¦ t : 'l ; ) '' V

; '! ¦' '' ¦¦ M. . • ' 1 , . ! ! 1

They laughed in 1970 when Harry Browne wrote How You Can Profit from the Coming Devaluation. Against all the wisdom of the day, he argued that the dollar wasn't as good as gold, that the false prosperity of the 1960s would lead to inflation in the 1970s, and that the time had come to get out of stocks and bonds and into gold and silver.

In 1971, the dollar was devaluated, gold and silver began rising, inflation led to wage and price controls, and the economy went into a nosedive. His readers made money.

They laughed again in 1974 when he said (in the #1 best-seller You Can Profit from a Monetary Crisis) that the crises had only begun. He expected much worse inflation, more economic problems, and skyrocketing gold and silver prices.

And it all happened—putting enormous profits into the pockets of his readers.

In late 1978, in the midst of financial chaos and gold's new popularity, they laughed still again when Browne said (in New Profits from the Monetary Crisis) that we had to be ready for a better economic era, that we should no longer rely so heavily on precious metals, and that a broader portfolio of investments was needed for the 1980s.

But once again he was right. In eariy 1980, gold and silver peaked and then plunged, but stocks and bonds began rising.

Now, for the first time in a decade, he's written another crisis book—and no one's laughing. In The Economic Time Bomb, he explains how—in the midst of the prosperous 1980s—the economy has been quietly backed into a comer from which there's little chance of escape. He shows why the troubles of the

(continued on bade flap)

(continued from front flap)

1970s may be about to resume—taking us

back to alternating periods of recession and

inflation.

But this time the dangers are greater. This time we enter the crises with the economy already burdened by federal deficits so large they could send interest rates and inflation to the stratosphere. This time we already see hundreds of banks and savings & loans failing each year—with thousands more barely holding on. This time the government can't solve any problem without making another one worse. So this time we have to be ready for anything.

Fortunately, in this book Harry Browne shows you how you can use a proven and simple plan to make sure you're safe and sound—no matter what happens. Vissza

Témakörök

- Közgazdaságtan > Gazdaságpolitika

- Közgazdaságtan > Közgazdasági elméletek > Tőkés országok gazdasága

- Közgazdaságtan > Gazdaságtörténet > Tanulmányok

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Gazdaságpolitika

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Közgazdasági elméletek > Tőkés országok gazdasága

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Gazdaságtörténet > Tanulmányok